It is essential that families dealing with bereavement have a reliable and experienced Wills solicitor to help them sort out their affairs.

Simply.Law can put you in touch with a solicitor for Wills and Will-related matters, including deeds of variation, who fully appreciates your circumstances – ensuring the minimum of distress and inconvenience to you and those close to you.

If you are unsure about the legal services you need, or require a specialised lawyer, use our Simply.Law Match facility and we will suggest a selection of solicitors who best match your requirements – you can then view their profiles and decide which one you would like to make contact with.

What is a deed of variation?

A Deed of Variation is (also known as an Instrument of Variation, a Family Arrangement, a Deed of Surrender, or a Deed of Assignment) is an instrument enabling a beneficiary to pass on their entitlement (whether in a will or via intestacy) to another person or party.

What is significant about a deed of variation is that it allows the beneficiary to pass on the entitlement without incurring any tax consequences; as such in terms of Inheritance and capital gains tax it is as though a gift has been made by the testator.

How to make a deed of variation?

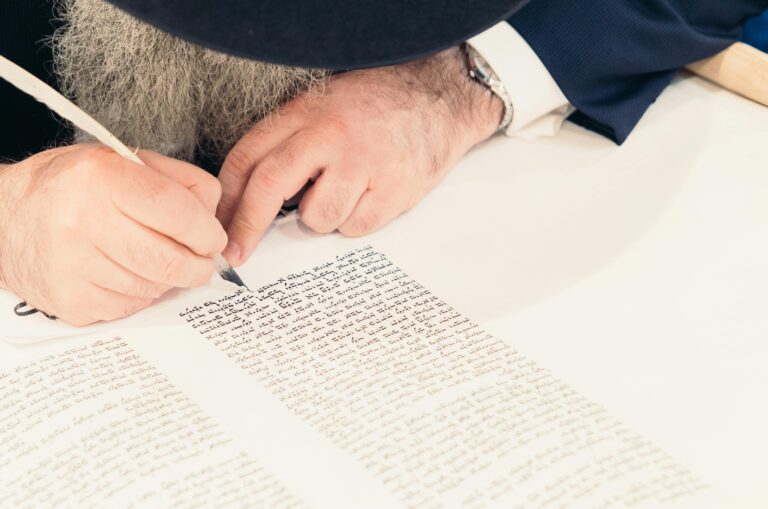

A deed of variation must be made in writing and, ideally, should be done formally with the assistance of an experienced Wills solicitor.

For a deed of variation to be legally valid it must be submitted within two years of the date of death, must clearly identify all relevant parties and must be signed by all beneficiaries who are affected by the document.

Why make a deed of variation?

There are many reasons a person might decide to make a deed of variation. These may be personal, financial or simply a matter of individual principle. For example, it may make sense to pass on assets to the next generation or it may be that it makes sense in terms of taxation.

Importantly, a deed of variation allows a beneficiary control over assets; ensuring they are used in a way they see fit, particularly if the circumstances of beneficiaries and other relevant parties have changed since the time of the writing of the Will.

Wills solicitors for deeds of variation

Simply.Law’s member Wills solicitors have the experience and expertise to help you use a deed of variation to reallocate property or assets in the way that is accordance with your objectives, but without incurring any gifting tax.

Whether you wish for a more equitable distribution of assets, an arrangement that considers the full implications of inheritance tax, or to ensure that the original spirit of a will is preserved but with full consideration of changed circumstances, browse our member profiles to find the Wills solicitor who is right for you.